As revealed in Digital Banking Report’s “Improving the Customer Experience in Banking” report, the vast majority of the financial services organizations surveyed agreed that customer experience was an important area of concern, but only 37 percent of them had a formal CX plan in place. While your company may have a G.O.A.T.—that special person who is killing it—you need to be able to scale their success to gain a larger share of wallet. In this post, we’ll discuss six keys to sales engagement for financial services.

-

-

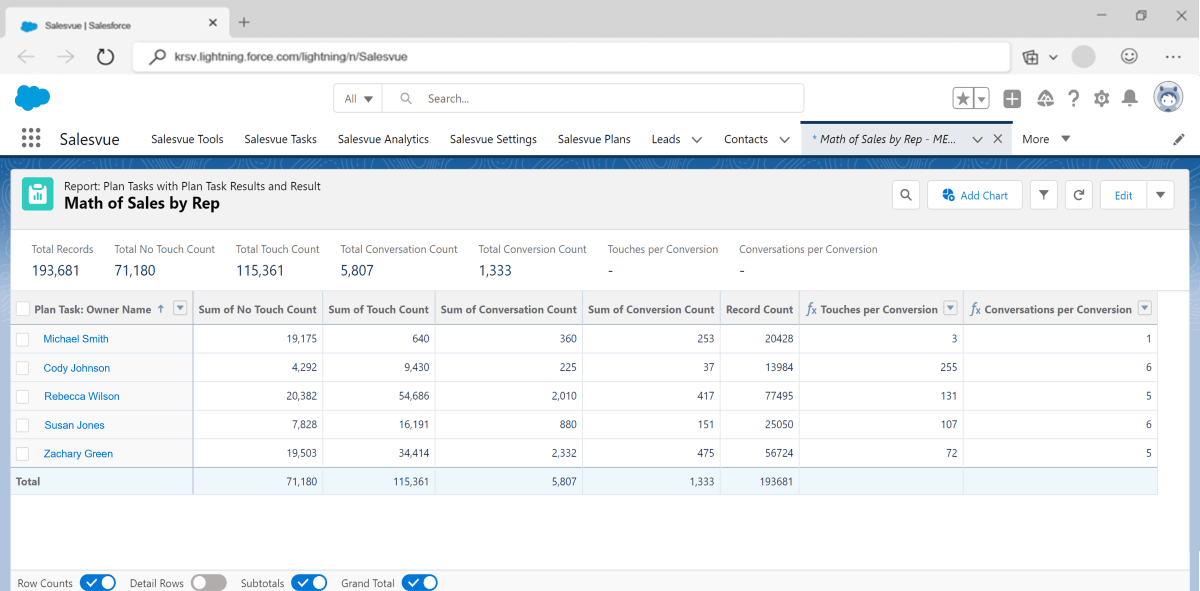

- Align sales and marketing. Foster a solid working relationship where sales and marketing departments meet regularly to be educated on product lines, analyze pipeline data, identify prospects, and plan for capturing market share. This may sound like a pipe dream because sales and marketing teams often work in silos or are at odds with each other. They’ll be more likely to agree and work harmoniously with each other when they have evidence of what works and what does not and start getting wins under their belts. Using Salesvue’s Math of Sales™, your teams can compare performance for sales reps, cadences, lead sources, industry targets, job role targets, or any other Salesforce data you have.

- Continue to feed the funnel. Use data from existing customers to identify the best fits between your product line and prospective advisors. Take your ideal customers and look at their lead sources, industry, and job role. Then find other companies and prospects who are similar, and devise multi-faceted and targeted campaigns to market and sell to them.

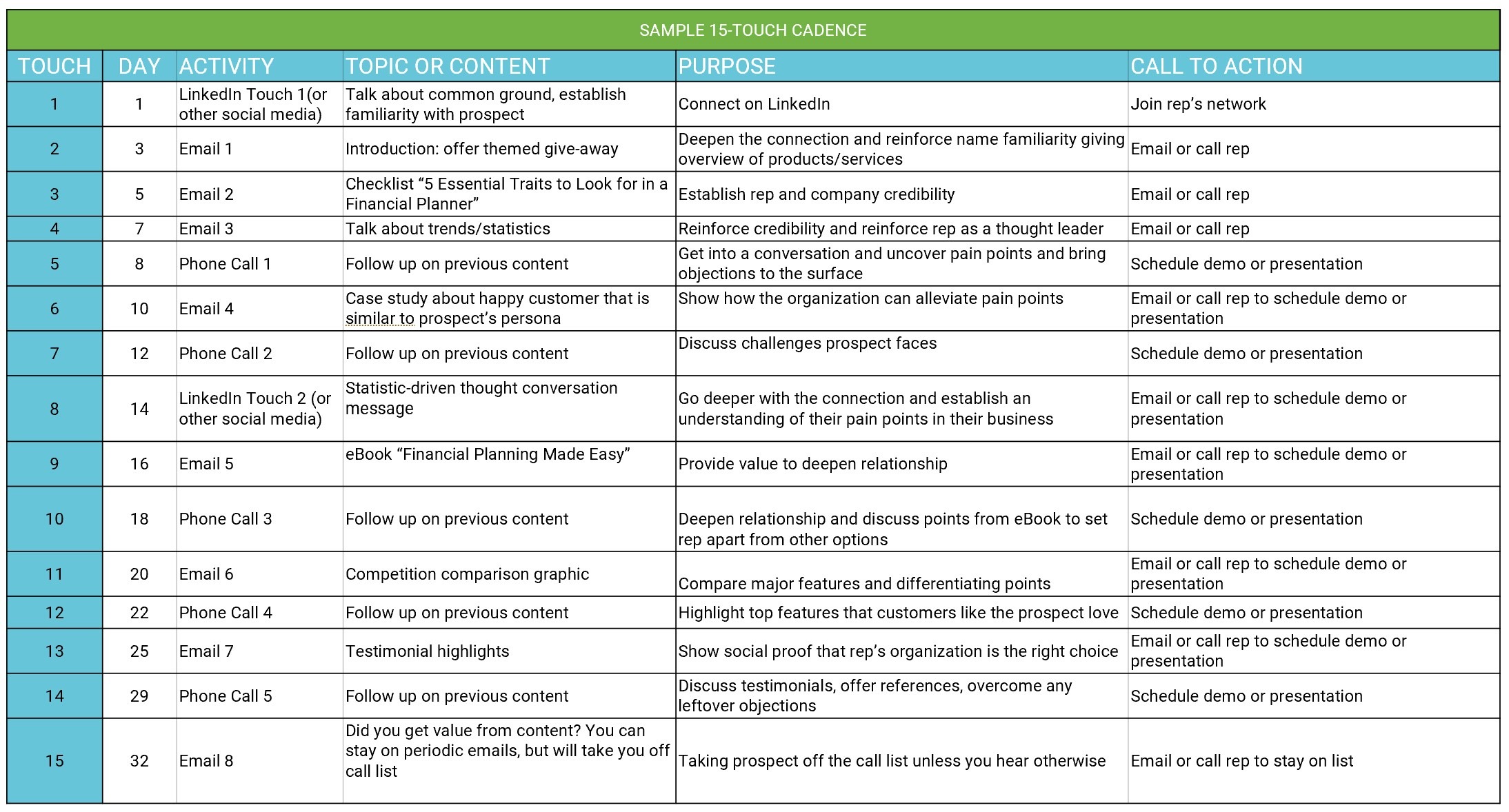

- Seize every opportunity. If the marketing team delivers high-value content in a persistent cadence, and the sales team follows up in a timely manner, your chances of engaging your clients multiplies. Salesforce and Salesvue data work together in one platform to provide insights about follow-up timeliness, consistency of contact, key drivers of success, and conversion rates across the entire life of the client relationship, so you can focus efforts on having the right conversations at the right time.

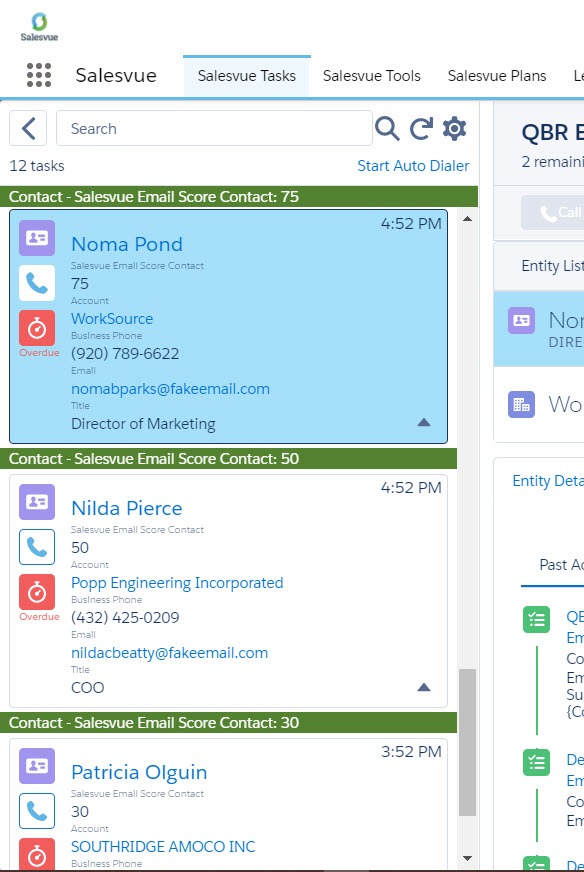

- Provide structure to the day. Cadences and a single interface for daily tasks provide the structure for consistent outreach, whether it be outbound prospecting, quarterly client touchpoints, or anything in between. And, email scoring makes sure there’s never a question which clients and prospects should get priority.

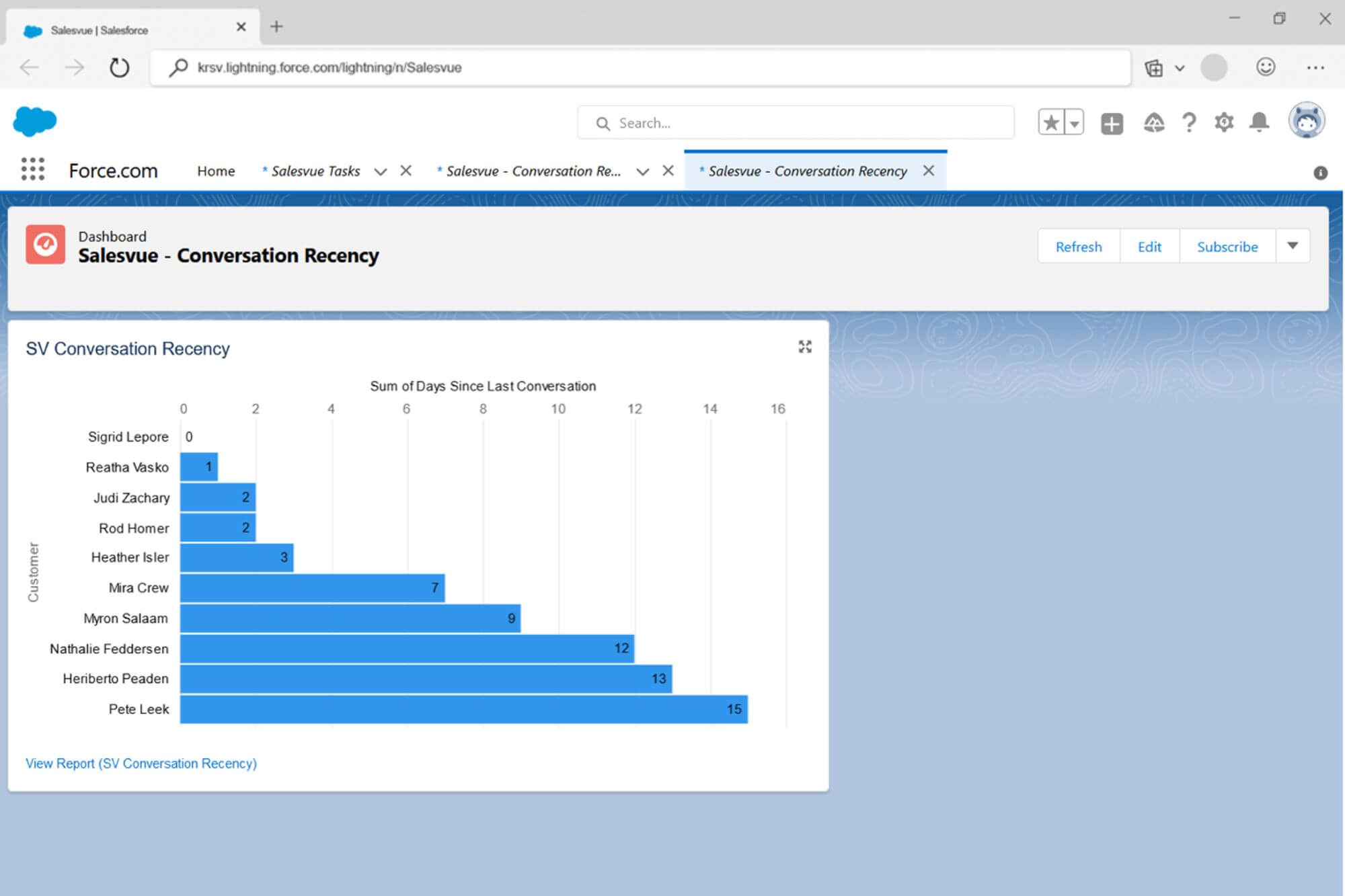

- Turn your “B” performers into “A” performers. Create cadences in Salesvue that take advantage of the best sales behaviors in your organization to help your advisors, wholesalers, and relationship managers to say the right thing at the right time to the right people. And see who is maintaining a consistent connection in the form of an actual conversation with their prospects and customers. The Conversation Recency Report allows you to compare performance for different segments of prospects or customers to identify areas needing more consistent and improved communication.

Get transparency in communications. The entire team has easy access to the full disposition of the deal and what steps to take next. With Salesvue’s mobile app, quickly document meeting results, ensuring meeting information is logged in Salesforce so your whole organization is up-to-date on client communications 24/7.

Get transparency in communications. The entire team has easy access to the full disposition of the deal and what steps to take next. With Salesvue’s mobile app, quickly document meeting results, ensuring meeting information is logged in Salesforce so your whole organization is up-to-date on client communications 24/7.

- Align sales and marketing. Foster a solid working relationship where sales and marketing departments meet regularly to be educated on product lines, analyze pipeline data, identify prospects, and plan for capturing market share. This may sound like a pipe dream because sales and marketing teams often work in silos or are at odds with each other. They’ll be more likely to agree and work harmoniously with each other when they have evidence of what works and what does not and start getting wins under their belts. Using Salesvue’s Math of Sales™, your teams can compare performance for sales reps, cadences, lead sources, industry targets, job role targets, or any other Salesforce data you have.

-

Category

Tags

Subscribe to Funnel Vision

Get the latest and greatest right in your inbox