Financial services are an enormous industry. With so many different bits and pieces making it up, financial services, or FinServ, is a huge part of not only the economy, but the general public’s lives as well. As with any industry, there’s specific terminology and use cases that help make their world go round. Whether obvious or not, sales are a huge part of FinServ. So, as with many other groups of sellers, Salesforce plays a big role in a financial services salesperson’s day. So, here’s our tips on how to help leverage Salesforce in FinServ efforts, even beyond Salesforce Financial Services Cloud.

Financial Services Sales Processes

While there’s many different types of sales processes within financial services, there’s some common trends between all of them. Typically, a financial service sales process will need the salesperson to leverage multiple platforms and types of software. While a CRM is great for storing contact data, they will also need cadences for structure to their day. For example, a wealth advisor needs to contact a prospect multiple times, all while staying organized.

They may initially make a few calls and send a few emails to them to try to get the prospect to do business with them. Then, the advisor needs to make sure they follow up with the customer on a regular basis, whether that be monthly, quarterly, yearly or anything in between. They also need to do this for the dozens of clients they may have. As you can see, these emails, calls and meetings add up quickly. Sticky notes and spreadsheets can only get you so far with a sales process as dynamic and crowded as most FinServ sellers find out.

How is Salesforce Used in Financial Services?

For many in the FinServ space, Salesforce acts as a great customer database. For those in the industry, contact information is extremely valuable. Whether it’s to help manage your own accounts and customers or see what’s out there to grow your book of business or hit your numbers, having access to these customers means the world. Also, the security that Salesforce provides is a key factor. Prospects’ and customers’ information needs to be secure for obvious reasons. So, not only is Salesforce a valuable tool for the salespeople, but it’s also a big factor for IT and security teams as well.

Sales Cloud vs Financial Services Cloud

For those familiar with Salesforce, you’re probably also familiar with their different Clouds. These clouds essentially tweak Salesforce towards certain needs. For example, there’s a cloud for sales, financial services, marketing, commerce and more. For the needs of this blog, we’ll highlight the sales and financial services clouds. The sales cloud is the one that most people think of when they think of Salesforce. Financial services cloud however, is more tailored towards those in the FinServ world.

The Financial services cloud is an option for organizations that want to make their Salesforce look like it was made for FinServ. In the FinServ cloud there’s a few differences that benefit these organizations than living in just the Sales Cloud would provide. The big difference is how in the Financial Services cloud there’s different types of records beyond contacts that are specific to FinServ. For example, you can leverage agencies as a record type. This helps teams in the space better align their Salesforce terminology with what they use in their actual sales processes.

The Ideal FinServ Sales Tech Stack

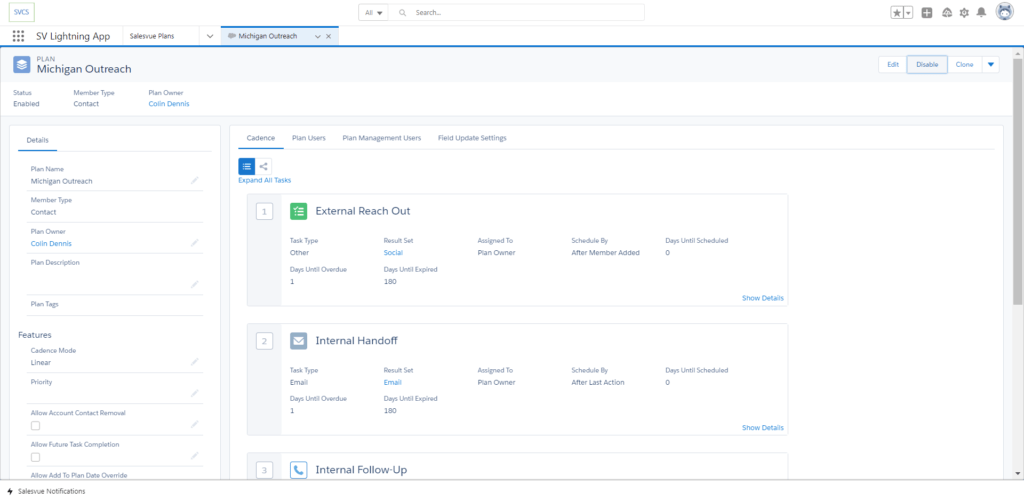

While there are teams who read that and assume the best way to make Salesforce work for their FinServ organization is only using what Salesforce has to offer, that’s not particularly the case. Salesforce has thousands of applications that integrate with it or live natively within it. One of these is Salesvue. Salesvue is a sales engagement platform that lives inside of Salesforce. While many cadencing solutions are their own separate software, Salesvue is Salesforce-native. This means you get all the benefits of a cadencing solution, but with the UX of Salesforce. Also, it works for teams using both Salesforce Sales Cloud and Salesforce Financial Services Cloud.

There are other benefits of this as well. A big one, especially for FinServ companies, is this helps with data security. Since all your data and sales processes live within Salesforce, you don’t need to sync data in and out of your CRM, like you would with non-native sales engagement tools. Whether you’re using Sales Cloud or Financial Services Cloud, keeping your data in one spot is a good thing. Knowing how necessary data security is for these companies, this can be a game changing feature.

For FinServ teams wanting to get more out of Salesforce, here’s a few use cases to help show how Salesvue can fit into and improve your sales process.

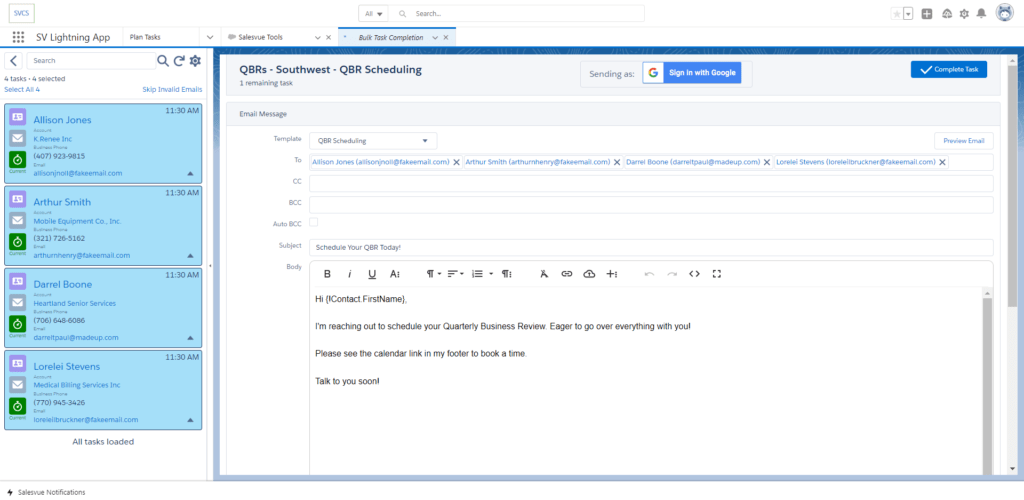

For Insurance Companies

Salesvue understands the importance of keeping the whole team aligned on the same page. Everyone from agents to wholesalers to leadership needs to understand what’s going on. This includes both internal and external reps. For example, if an external field rep has a meeting with a prospect, they can automatically record meeting notes through the mobile app and move the prospect along using different task resolutions depending on the outcome. From here, the prospect may be automatically put in a cadence for an internal rep to then contact. This helps coordinate efforts, regardless of where your sellers are working from.

A key piece to pull from this, besides the mobile app functionality, is the use of cadencing. When we say, “move the prospect along”, we’re referring to moving them along a cadence. We understand how important it is for wholesalers to follow up and have structure in their efforts. Without it, they could miss a follow-up for one of their clients, or even forget to send the email that gets them a new one. Leveraging our cadencing capabilities helps wholesales create best practices and stick to them.

For Bankers

In terms of banking, Salesvue can help organizations grow their AUM and book of business. Salesvue helps treasury managers and relationship managers organize their days and connect with contacts. Following up and staying top of mind with prospects is vital in this world, so Salesvue makes it easier by telling you who to call and when.

Take a relationship manager for example. They can start their day by sitting down and having all their tasks laid out for them. No need in wasting time figuring out what to do first. They can see who they need to call and who are the best prospects to reach out to. From here, through automation and this structured process, they can move through their tasks quickly for the day, before getting to spend a majority of their time and brain power on major tasks.

Summary

For financial services teams, Salesvue can be the answer you’re looking for. At Salesvue, we understand all the details and differences in each section of the FinServ industry. This is why our product is made with these teams in mind. Whether you’re using Salesforce Sales Cloud or Salesforce Financial Services Cloud, Salesvue is built for you. We built our cadencing solution inside of Salesforce, eliminating security concerns, and giving you everything you need to be successful in a single spot. Salesvue can help boost your Salesforce to help you get more out of it, helping you close more deals.

Category

Tags

Subscribe to Funnel Vision

Get the latest and greatest right in your inbox